Acquisitions

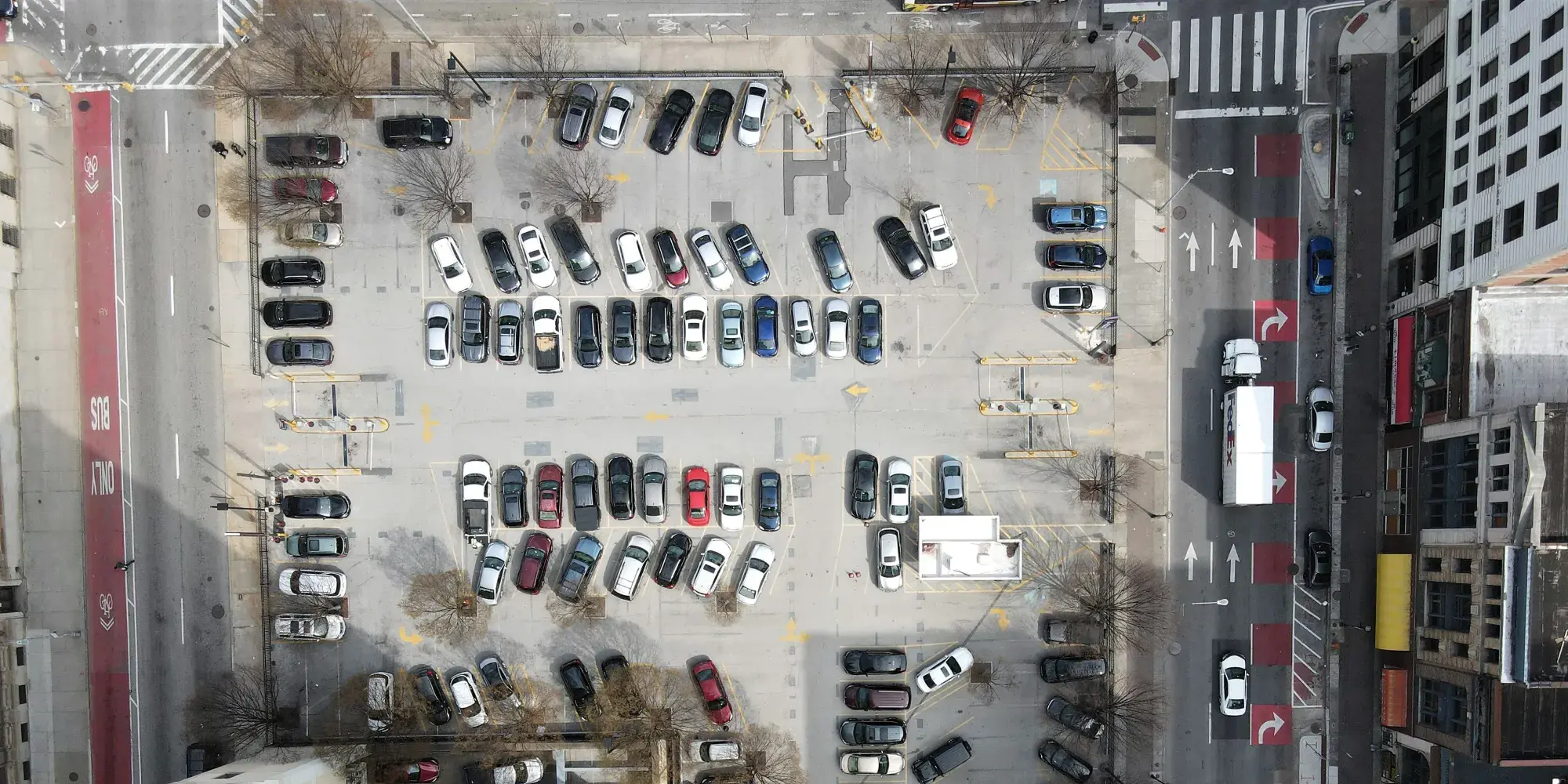

Parkway is an active acquirer of parking real estate assets.

Seeking quality and delivering excellence

For generations, Parkway has leveraged innovative management, state-of-the-art technology, customer service solutions, design, real estate acumen, and joint-venture-based collaboration to maximize parking asset values. We aim to create scale and diversification across markets to capitalize on emerging trends in the parking sector, commercial real estate generally, and the broader economy.

Acquisition Criteria

Type: Surface lots, garages, buildings with excess land, or dilapidated/compromised structures

Profile: Strong parking fundamentals and proximity to multiple demand drivers such as medical facilities, hotels, dining destinations, performance venues, government centers, courthouses, stadiums, arenas, convention centers, museums, airports, and office buildings

Minimum Lot Size: 0.50 acres / 20,000 square feet (will consider smaller sizes, if strategic)

Minimum Deal Size: $1,000,000 purchase price

Geography: Top 100 MSA’s with a preference for emerging markets experiencing in-migration and job growth; will consider trending sub-markets with good longer-term growth prospects

Purchase Structure: Fee Simple, Joint Venture, Ground Lease, Installment Sales